Ontario Ministry of Health has been publishing COVID-19 data for Ontario every day on their website. As far as I know, they have not made it available in a time series format for those of you who like to see the full data since the pandemic began in Ontario. I have been collecting this data and have decided to open source it on my github page. I will continue to collect and publish this data, daily, for those that might find it useful.

Some preliminary findings for Ontario

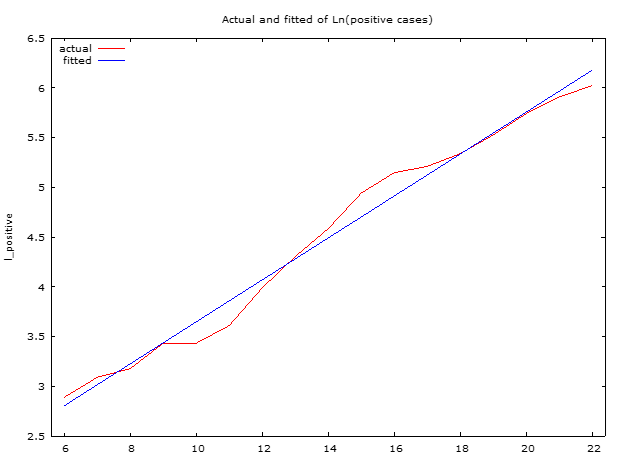

Unfortunately, preliminary findings show that Ontario is still on the exponential growth path. The straight line in the following graph shows an exponential fit to the data (R-square = 0.98).

But there is hope. In the last two days, the red line has been shifting from the trend. This could be a break in the exponential growth path (social distancing working) or statistical anomaly. Only time will tell.

Current best model fit for the number of Ontario cases is: $$Number\:of\:positive \: cases= e^{1.54+0.21*Days_{since \: Feb\: 29,\:2020}}$$

Comparison to the Chinese experience

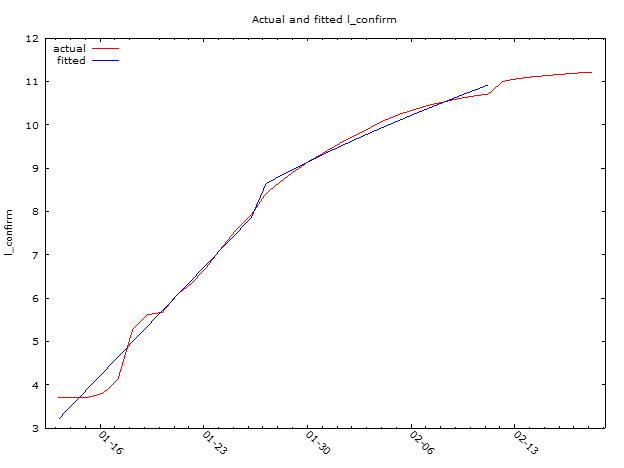

Looking at the Chinese data there is a break in the trend around January 26, 2020. A statistical model of the Chinese data shows this clearly.

Ontario is still below the point at which the Chinese managed to curb the growth rate of the virus. We are about 11 days away from that event. In our favour is the fact that we are on a less steep path. So we have a bit more time to act and restrain the spread. But we need to do it fast. There is still time to take more action. From what I am observing most of us are doing just that. Bravo but let’s keep this social distancing going.

Recent Comments