I would like to preface this post with the statement that I have no special information about the Bank of Canada’s decision on interest rates tomorrow – March 4, 2020. However, as a keen observer of monetary policy, I have to disagree with the market expectation of the bank decreasing the interest rate. There are a few reasons why I disagree.

The problem with COVID-19 is that it is a supply-side shock unfortunately, the bank doesn’t have a lot of tools to deal with supply shocks.

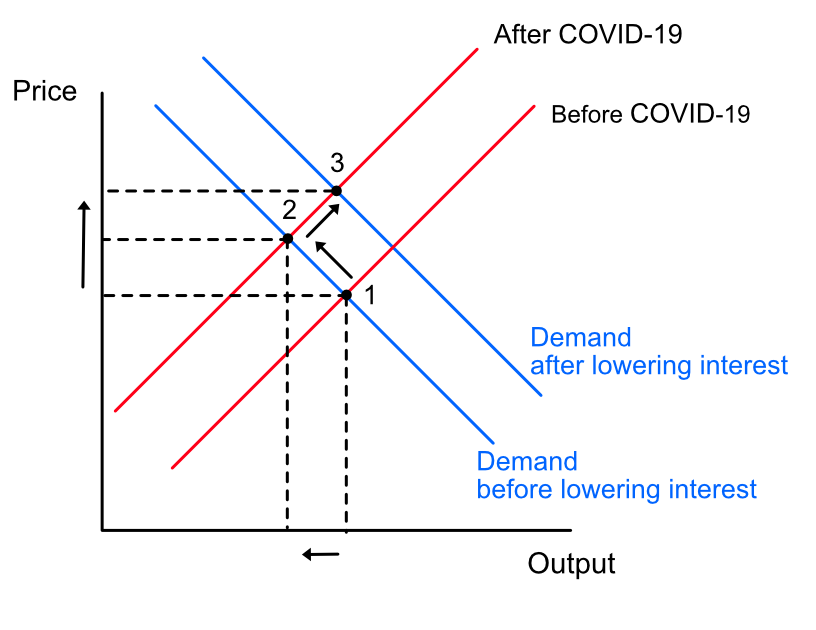

But why is a supply-side shock a problem for the bank? Let’s look at an example of a supply-demand relationship.

In a supply shock, we have the supply curve moving up and to the left (from 1 to 2) leading to higher prices (higher inflation) and lower output. Now think about what happens if the bank lowers rates. Rates are lower so borrowing is easier for both consumption and investment. As a result demand increases. In our graph world, the demand curve moves to the right (from 2 to 3). But observe what happens to prices. They go even higher. This is counter to the bank’s focus on low and stable inflation.

Besides, lower interest rates means lower mortgage rates. The bank has been, for a few years, worried about the stability of the financial system because of high personal debt due to increase borrowing in certain segments of the housing market.

If you observe inflation rates, a key target for the bank, there is no hint at this time that rates are increasing. Obviously, they will go up due to the supply shocks from the virus but those will be temporary until supply improves. Impacts are still going to be felt in the future. Even if the bank acts at this time, we know that monetary policy has a lag. So the full effects would be felt in 6-8 quarters. By that time, it is unknown if COVID-19 will still be active.

If the bank acts now this puts us closer to the lower zero bound. If a real demand shock is going to occur in the near future, it will limit the bank’s effectiveness and ability to deal with it. There are a few more reasons I can think of why the bank would not want to lower rates now. I leave it to you to discover on your own. (hint: what happens to GDP when consumption and imports decline?)

Of course, this is just a prediction and I could be completely wrong. I have been surprised by the bank’s actions in the past. We will find out in a few hours.

Update (2020-03-04): The bank lowered interest rates this morning by 0.5% to 1.25% due to a weaker outlook as compared to January. The bank prefaced this by saying that it stands ready to “support economic growth and keep inflation on target”. I find this statement a bit unusual for the bank because the bank’s primary focus is on inflation (see the Bank’s monetary policy objectives). By including supporting economic growth in-front of focus on inflation does the bank try to signal a change in attitude away from inflation and towards a dual mandate like the Federal Reserve in the US or is this statement meant to reassure business sector confidence?

Recent Comments